YNAB has a lot of really great support resources that you should probably check out. There is a YouTube playlist by YNAB which acts as a primer for nYNAB as well.

Ynab 4 help free#

Feel free to post your questions, budget strategies & advice.įor veteran users, learn more about the changes to the new rules in the Transition Guide. We welcome any posts here regarding YNAB.

Ynab 4 help software#

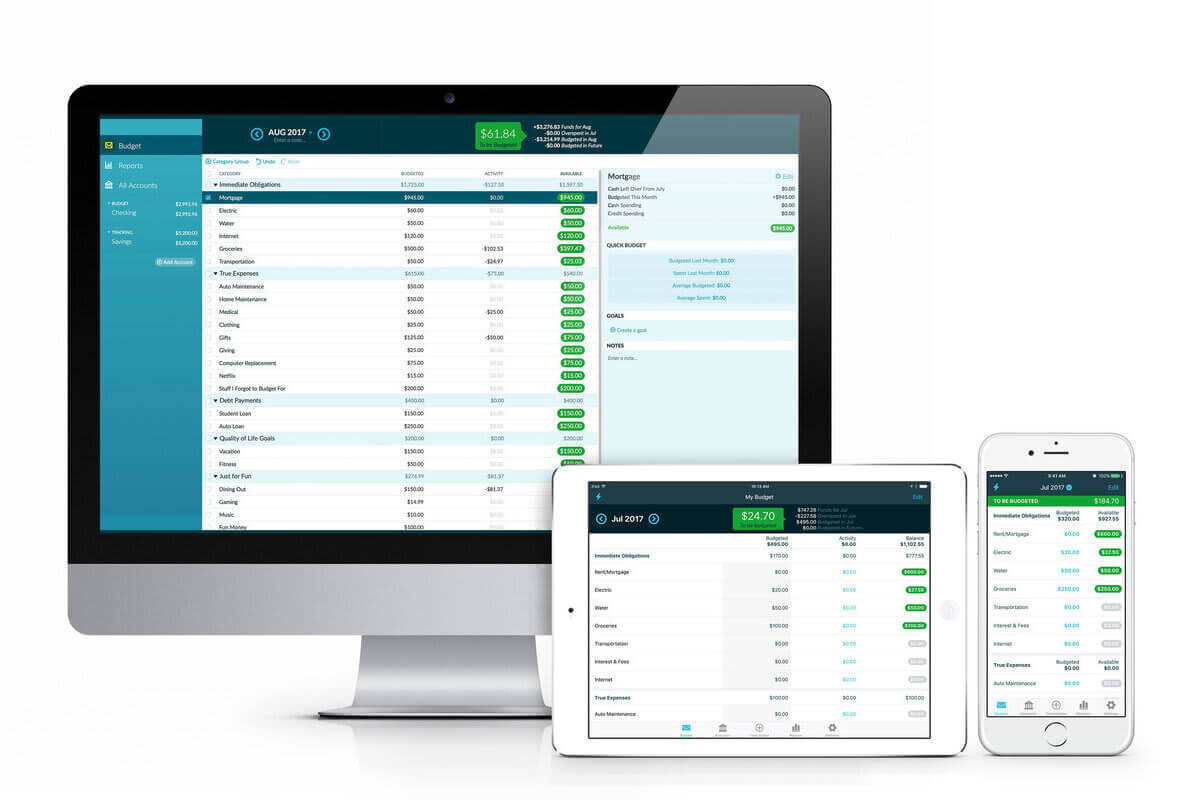

This subreddit is dedicated to discussion on the popular budget software You Need A Budget. NYNAB was last updated 10 November 2021 Welcome to /r/YNAB Filter out today's "Rant" and "Rave" threads.But, it’s on you to make it work.Welcome to /r/YNAB! Check out the wiki, and new users please read this helpful page!

Ynab 4 help how to#

With a wealth of support and four rules to teach you how to interact with your money in a positive way, YNAB is setting you up for success. Now, will YNAB help you save as much as they claim? It’s highly possible that it will. A good budget will help you see when you need to make more money, where you’re spending too much, and how to reconcile everything.Ī budget alone is a powerful tool and YNAB users overwhelming say that budgeting with YNAB has helped them gain control of their finances and work towards a better future. Knowing how much you’re earning, how you’re spending it, and taking control of every dollar that goes in and out is one of the only ways to make big financial goals happen. There’s nothing wrong with that, but you should know that before proceeding.Īnd in all honesty, having a budget is one of the most important parts of a healthy financial life. You may have gotten this point already, but I want to say it again.

YNAB isn’t the only budgeting app that uses zero-based budgeting – Dave Ramsey’s budgeting app EveryDollar is built on the same principle. And YNAB’s second rule, roll with the punches, reminds you that it’s okay to move money around if you occasionally overspend. You know exactly how much you have to work with and where it should go. With zero-based budgeting, there is no guesswork. Zero-based budgeting gives you the flexibility to buy all the lattes you want… or whatever extra expenditures you have… while showing you how those lattes will affect what you have to put towards other expenses.

See, what happens for a lot of people is that they approach debt and savings by saying, “I’ll take care of that with what’s leftover at the end of the month.” In that lies a problem, because unless you make a point to use a certain amount of money for savings or debt payments, it’s really freaking easy to have nothing left at the end of the month. Zero-based budgeting teaches you that you are in control of every dollar you are earning, and it’s incredibly effective for people who want to pay off debt and/or build their savings. YNAB uses zero-based budgeting, or what they call budgeting to zero. These rules are meant to alter the way you approach spending, saving, and even thinking about money. These rules are the core of the YNAB app, and they are why many users consider YNAB to be a complete game-changer. It’s easier said than done, but working the other three rules is meant to help you stop living a paycheck-to-paycheck lifestyle. The purpose of this rule is to help you start living on last month’s income. This rule is about flexibility and teaches you that it’s okay to move money around when you need to. It’s easy to overspend in some categories, and some expenses require fewer funds than you allocate money towards. Realizing that you will have some less-frequent expenses, like holiday spending or vacations, you set an amount to spend on those and save up for each. The idea is to prioritize the money that’s coming into your accounts to everything from household and living expenses, savings, and debt. You take the money you earn and allocate every single dollar you make to different expenses. YNAB is solely a budgeting app, and it was built on a few seemingly simple rules: It was founded in 2004 after real-life couple Jesse and Julie Mecham realized they needed a better system to budget their money.

0 kommentar(er)

0 kommentar(er)